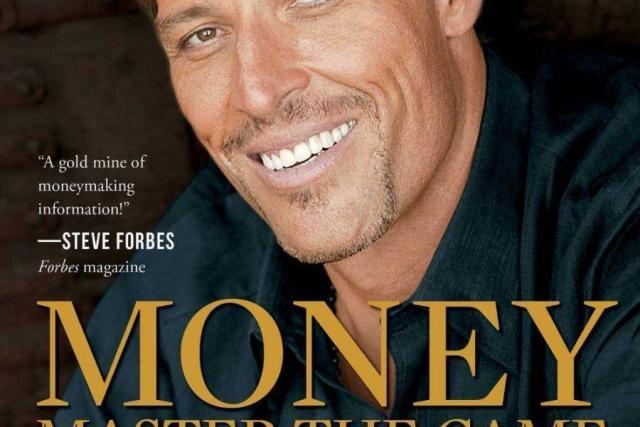

Tony Robbins's book "Money Master the Game" was recommended to me on multiple occasions. In short, the book holds amazing information and insights and has been the most valuable book I've read this year. My only criticism is that Tony might be interpreted easily sidetracked because he's used to life coaching advice (which he excels at). I recommend you buy and read the book, his background stories add to the complete picture.

Calculate how much money you need to have an income for life

Use low cost index funds and bonds

Security bucket (your age in %)

Risk bucket

Dream bucket

Don't actively manage

Diversity, diversity, diversity

Invest on a set schedule and rebalance periodically

There are other views

Money is only part of the equation

Final note: this summary is far less powerful if you haven't read the book.

How to read the summary

This summary highlights what I thought were the most important takeaways from the chapters in the book. You will find:

- Short paragraphs and examples per chapter

- TL;DR sections (Too Long Didn't Read, meaning summary for lazy or rushed readers)

I recommend using this summary as a reference after you read the book. You can read it as it is as well. This Money Master the Game summary based on Tony Robbins's book is written as a reference guide for myself, not everything is in here.

Section 1: Welcome to the jungle

Chapter 1.1: It's your money! It's your life! Take control!

TL;DR: Money isn't a goal, it's a means to an end. Most people don't want money, they want a certain lifestyle or emotional security. You are the master of your financial and emotional success.

- Most people in the finance world don't practice what they preach

- People who succeed aren't lucky, they do things differently

- Success leaves clues, model the people who made it

- There are passive ways to win that beat 96%+ of active stock traders

- The financial sector seems needlessly complex

- You need to take control of your money

Chapter 1.2: Create an income for life

TL;DR: Our goal is to create an automatic paycheck machine using investment. You are responsible, act like it.

- Take responsibility for your retirement

- Tax efficiency is very important

- 53% US households are at risk of having insufficient retirement funds

- Complexity is the enemy of execution, make a plan and make it simple

- Make a plan, stick to it and readjust course once or twice a year

Chapter 1.3: Make the most important financial decision of your life

TL;DR: Compound interest is more powerful than you can imagine. Start saving and investing as soon as you can. Example of 2 brothers retiring at 65

Brother 1

- Starts at 20 years old

- Saves $4000 a year for 20 years

- Leaves the money alone for the last 25 years

- Total of $80,000 savings

- 10% growth a year

Brother 2

- Starts at 40 years old

- Saves $4000 a year for 25 years

- Lets the money grow until age 65

- Total savings of $100,000

- 10% growth a year

Results

- Brother 1: $2,500,000

- Brother 2: $400,000

Yes, it is that powerful. Why? The interest of next year also grows your interest of this year.

- You always find ways to spend available money

- Make saving a personal tax (% of income), unavailable for spending no matter what

- Use 'start saving tomorrow', meaning you assign 50% of income increases to saving

- You can live off interest with far less money that you realise

Chapter 1.4: It's time to break through

TL;DR: Humans have common factors that make then feel happy and fulfilled.

Whatever you are after, Tony names 6 basic human needs for success and happiness

Certainty/comfort

Uncertainty/variety

Significance

Love & connection

Growth

Contribution

Inspect in yourself to what extent you have which needs

Gratitude and giving back serve many needs

Section 2: Becoming an insider

Don't get in the game unless you know the rules.

Chapter 2.0: Shattering the 9 financial myths

TL;DR: A whole bunch of stuff you believe is wrong, most of it actually.

Myth 1: Invest with us! We'll beat the market! + 96% of actively managed mutual funds don't beat the market (index funds) over any sustained period of time + Only very few people (the 'unicorns') beat the market consistently, and they take only high value clients

Myth 2: Our fees? They are a small price to pay! - Average mutual fund cost: 3.17% including hidden fees

Example of fee impact

3 friends

- All invest $100,000

- All funds perform at 7%

- All start at 35 years old and stop at 65

Friend 1 (3% fees) result: $324,340

Friend 2 (2% fees) result: $432,194

Friend 3 (1% fees) result: $574,349

Myth 3: Our returns? What you see is what you get. + Time weighed "average" return is deceptive + Imagine the return going up 50% and down 50% every year. Average 0% return. But you lose money

- The dollar weighed return is what you need

- You invest spread out over a year, and thus step in at different points

Myth 4: I'm your broker and I'm here to help

- 96% of actively managed mutual funds don't beat the market (index funds)

- A broker means paying extra fees for lower performance

- 49% of managers own no shares in the fund they manage

- Brokers get paid affiliate fees for financial products

- Fiduciaries on the other hand are paid by you, so don't have ulterior motives

- 46% of financial planners have no retirement plan

- The difference between brokers and fiduciaries in a video

Myth 5: Your retirement is just a 401(k) away

- 401(k) is an American construct. Inapplicable for me.

- Many 401(k)'s are very high in fees, see myth 2

- Ask your employer to switch to a better 401(k)

Myth 6: Target-date funds: "Just set it and forget it"

- Target date funds automatically become more conservative as you approach retirement

- TDF's are based on assumptions about predictability that may very well be wrong

- TDF's are basically managed funds, no guarantee at all

Myth 7: I hate annuities, and you should too

- These are basically 'income insurance'. You pay now to get money back at a fixed rate later.

- The concept is great, but they are often abused (high fees, bad terms etc)

- Variable annuities are bad

- Jack Bogle likes annuities, if they are done right

- Always check the details, better yet let an expert look at them

Myth 8: You gotta take huge risks to get big rewards

- Big money looks for asymmetric risk/reward

- Example of Nickles: US nickles are worth more as melted metal than as coins. Kyle Bass bought $1 million in nickles. He had a 25% gain in value the second he bought them. And if the metal price drops, he has 100% of his initial investment.

- It is possible to have reward with low risk. People with money know this and use it.

Myth 9: The lies we tell ourselves

Our biggest limits are not external but self imposed

Cultivate a breakthrough moment where the impossible feels possible

Find a proven strategy that works for you

Tell yourself the right story, psychology is important in getting results

Example: "I have dyslexia so I can't study well" vs "I have dyslexia meaning I take more time studying and thus remember it better"

Example: two groups of people feel stress. Those who believe it is harmful experience issues biologically, those who see it as a performance booster get no side effects. (Mentor's note: yup, proven science)

Put yourself in the right state to achieve success

Change your body before your mind (easier to measure thus more motivation)

Section 3: What is the price of your dreams?

Chapter 3.1: Make the game winnable

TL;DR: Create a concrete picture of how much money you need

Pick three financial dream levels that matter to you, a short, medium and long term goal

Write down the among of money per year you need to achieve them

Monthly x 12 = yearly

There are 5 levels of financial dreams

Financial security: you can survive without working

Mortgage, utilities, food, transportation, insurance

Financial vitality: you can survive and indulge a little

Half of: clothing cost, dining & entertainment, small indulgences. Add your financial security to this.

Financial independence: you don't need to work to have your current lifestyle

Calculate your current yearly costs to live

Financial freedom: independence plus 2 or 3 extra luxuries

These luxuries you don't have to work for either. Think a boat, condo in a ski resort etc.

Absolute financial freedom: you can do whatever you want, whenever you want, within reason.

You are the creator of your life, not the manager

Tony's 3 step process

Unleash your hunger and desire, and awaken laser like focus

Take massive and effective action

Grace (luck, coincidence, god's hand)

Tony with this means a state of gratitude and trust that eliminates fear and insecurities

Calculate how much money you need to save

Assuming 5% interest you need 20 times your yearly target income

Assuming 10% interest you need 10 times your yearly target income

Interest x multiplier = 100

So if you assume 2.5% interest you need 40 times your target income

Chapter 3.2: What's your plan?

TL;DR: make a goal and stick to it.

Whatever your goal is, you need to make a plan and stick to it

It's not about having the most money, it's about knowing how much you need

Life is not a competition. It doesn't matter where you start, it matters where you draw the finish line and that you reach it

Save more strategies

Save more and invest the difference

Rate recurring expenses from 0 pleasure to 10 pleasure

Invest in yourself also

Earn more and invest the difference

There are always ways to make money

Reduce fees and taxes

Get better returns

Change your life and lifestyle for the better

You can save a lot of money by moving or changing habits, whilst increasing life quality

Section 4: The most important investment decision of your life

Chapter 4.1: Asset allocation

TL;DR: Asset allocation is the single most important thing

- Asset allocation is what keeps you wealthy over time

- Divide your investments over asset classes

- Bonds, stocks, real estate etc

Diversity across risk, make 3 buckets

- Security/peace of mind bucket

- Cash, cash equivalents, bonds, certificates of deposit, home, pension, annuities, life insurance, structured notes,

- Risk/growth bucket

- Dream bucket

Chapter 4.2: The risk bucket

TL;DR: Separate risk from security

Be willing to lose most or all of this

Asset classes

Equities, equity etf, high yield bonds, real estate, commodities, currencies, collectibles, structured notes

Diversify. When indoubt, diversity. On second thought, diversity.

Diversity across classes, markets and across time

Index funds are diverse by nature

Want to day trade? Use a small portion of the risk bucket

Determine the sizes of the buckets

based on age, risk tolerance and liquidity

70% risk bucket is very aggressive

Rule of thumb, invest your age in bonds (portion of security bucket)

Chapter 4.3: The dream bucket

TL;DR: Save for treats.

- For strategic splurges, enjoy your wealth along the way

- How to fill it

- Unexpected big scores

- Risk/growth gets a positive hit

- Set percentage of income

Chapter 4.4: Timing is everything?

TL;DR: Don't try to time markets. Use dollar cost averaging.

- You can never predict a market, only estimate. Don't bet on entry points

- If you think you can time the markets, you are wrong

- Use dollar cost averaging (diversifying across time)

- Invest on a set schedule on a set plan

Example of dollar cost averaging

Index fund 1

- Invest $1000/year ($5000 total)

- Year 1: $100/share

- Year 2: $60/share

- Year 3: $60/share

- Year 4: $140/share

- Year 5: $100/share

Index fund 2

- Invest $1000/year ($5000 total)

- Year 1: $100/share

- Year 2: $110/share

- Year 3: $120/share

- Year 4: $130/share

- Year 5: $140/share

Intuition: index 2 is better. Reality: dollar cost averaging over a volatile market can be very good

- Results index 1: $6048

- Results index 2: $5915

If the market dips, your shares get cheaper

Balance your portfolio 1 or twice a year to keep your security/risk bucket percentages stable

Use tax-loss harvesting

Section 5: Upside without the downside

Chapter 5.1: The all seasons strategy

TL;DR: A historically stable portfolio.

Ray Dalio's recommendation

10% returns anually between 1974 - 2013

High safety and low volatility

The 1% of the 1% invest with Ray Dalio

Stock is 3x more risky than bonds, a 50/50 portfolio in stocks and bonds means you have a vast majority of your risk in the stocks

The portfolio is optimized to withstand the 4 seasons

The combo's of inflation, deflation, rising economic growth and falling economic growth

The all seasons portfolio

- 7.5% in gold

- 7.5% in commodities

- 30% in stocks

- 15% in intermediate US bonds

- 40% in long term US bonds

- Portfolio must be readjusted to maintain these ratios

Chapter 5.2: It's time to thrive

- Shows how well the all seasons portfolio does

- If you lose 50% of your money, you need 100% gain to get back up

- Recommends stronghold financial to look at your broker/401(k) for free

Chapter 5.3: Creating your life income plan

- The end game of investing is income

- Average returns is a deceptive statistic

- Annuities can be great secure income generators

Chapter 5.4: Time to win

TL;DR: Annuities can be good if you take the right ones.

Immediate annuities

For starting at a late age

Pay a bunch of money now and get income

The company bets that more people die than live to cash in

Deferred annuities

Fixed annuity: Independent of the market. You know what you will get

Indexed annuity: Get paid a bit more if that market does well, but lose nothing (and gain nothing) if it doesn't

Hybrid/fixed indexed annuity: Get the benefits of both of the above (Tony likes, upside no downside)

Variable annuities: avoid.

The longer you wait the more you get

Chapter 5.5: Secrets of the ultra wealthy

TL;DR: US tax benefits.

- All US based tactics

- Private placement life insurance

- Living revocable trust

Section 6: Invest like the 0.001%

Chapter 6.0: Meet the masters

- Tony talks about the people he interviewed

- Common obsessions/focus he found

- Don't lose money

- Risk a little, and make a lot

- Anticipate and diversify

- You're never done (learning, earning, growing etc)

Chapter 6.1: Carl Icahn

- Came from nothing, made his fortune

- Activist investor

- Improves companies by replacing management with good people

Chapter 6.2: David Swensen

Yale's chief investment officer

Mutual find performance is even worse than it seems because it only includes surviving companies

Don't just chase historically well performing things

Three levers you can push as an investor

Asset allocation

Market timing

Security selection

Likes index funds, it's easy diversification

Also diversify across funds

Equities are at the core for long term portfolios

Use different types of securities

Chapter 6.3: John Bogle

- Creator of the index fund and the Vanguard group

- Started working at age 9 delivering newspapers

- There is no such thing as a permanently good investment manager, it's 95% luck 5% skill

- Loved low cost index funds, obviously

- Chances of a worldwide depression maybe 1 in 10

- Three core principles

- Asset allocation based on your risk tolerance and goals

- Diversify through low cost index funds

- Have as much in bonds as your age (crude benchmark)

Chapter 6.4: Warren Buffet

- Tony and Warren talked briefly by chance

- "I'd love to help, but have said everything there is to say"

- 10% in government bonds and 90% in a very low cost S&P 500 index fund

Chapter 6.5: Paul Tudor Jones

Robin hood foundation

28 consecutive lossless years

Risk control is the single most important focus every day

Two things to remember

Be with what the predominant trend is

Five to one ratio of asymmetric risk/reward

Bases his decisions on the 200 day moving average

Chapter 6.6: Ray Dalio

- Founder Bridgewater Associates

- He's covered earlier

Copy for convenience: the all seasons portfolio

- 7.5% in gold

- 7.5% in commodities

- 30% in stocks

- 15% in intermediate US bonds

- 40% in long term US bonds

- Portfolio must be readjusted to maintain these ratios

Chapter 6.7: Mary Callahan Erdoes

- CEO JP Morgan asset management division

- Since she took over the division it grew more than half a trillion

- Money business is about results, as a woman it is great

- There is no one size fits all

- Active management works if the trader is good

- Invest for the long term and only take money out if you really need it

Chapter 6.8: T. Boone Pickens

- CEO BP Capital Management

- Shareholder activist (corporate raider)

- Willing to take big risks for big rewards

- Have a good work ethic

- Get a good education

- Virtually all assets in energy

Chapter 6.9: Kyle Bass

- Founder Hayman Capital management

- Was a springboard/block diver (Mentor's note: approval)

- Predicted housing crash and made money on it

- Uses asymmetrical risk and reward

- Buy a whole load of nickles if you can

Chapter 6.10: Marc faber

Publisher of Gloom, Bloom & Doom

In the investment world, everything is a lie

Emerging world is risky, US too stagnant

His portfolio for the climate of 2013 (roughly)

30% bonds and cash

20% stocks

30% real estate

25% gold

He realizes this is above 100%, it's a guesstimate

Traditionally holds emerging market bonds

Most important: it's not important what you buy, but what price you buy it at

Be careful not to buy things at a high price

Chapter 6.11: Charles Schwab

- Charles Schwab Foundation

- Trying to make products for the customer

- 98% of people should use low cost index funds

- Asset allocation is the single most important desicion you make

- Advice to his kids and grandkids

- Get the right education

- Get a well paying job

- Put money in your IRA/401(k)

- Then start 'proper' investing

Chapter 6.12: Sit John Templeton

- Founder Templeton Mutual Funds

- There is no disparity between spirituality/ethics and business

- You don't want to be your own doctor, you don't want to be your own investment manager

- Invests in anything he thinks will turn a profit

- Only sell an asset if you find an asset that is a 50% better bargain

- Don't be a go getter be a go giver

Section 7: Just do it, enjoy it and share it

TL;DR: Money is only one part of the equation.

Chapter 7.1: the future is brighter than you think

Technology is awesome

It will decrease cost of living

It will increase life span

Technology develops exponentially

Basically a chapter about technological awesomeness

Chapter 7.2: The wealth of passion

Everyone wants to be happy

Success without fulfillment is the ultimate failure

Change your life in 3 decisions

What will you focus on

What does this mean

What am I going to do

Use priming, Tony does it every morning

Chapter 7.3: the final secret

Money can increase hapiness if used right

Invest in experiences

Buy time for yourself (outsource)

Invest in others

It's been shown that spending money on others increases happiness more than spending it on yourself

Especially when you experience the result together

Focus on being grateful, forgiving and compassionate

The secret to living is giving