So you decided to invest, you have picked a strategy and you know how to buy financial products. For most of you, your strategy will lead you to invest in either:

- Mutual funds that invest on your behalf (like Vanguard's excellent low-cost options)

- ETFs (exchange traded fund) that hold assets corresponding to an index

An ETF is a stock you can buy that represents a strategy.

If you want to invest in the S&P 500 index (which tracks the US market), you could either buy a lot of different stocks (and need a lot of cash), or buy shares in a company whose goal is literally to just implement the S&P500 so you don't have to.

Hence the name ETF:

- Exchange (it is on a stock exchange)

- Traded (you can easily buy it)

- Fund (an organisation that invests)

For the sake of this post, I'm assuming you decided on the Buffett style strategy which can be implemented 100% with ETFs.

Choosing the index that suits you best

Most Americans know of the S&P 500, which is an index that represents how the biggest companies in the US are doing. But many countries and regions have indeces.

Geo Indeces

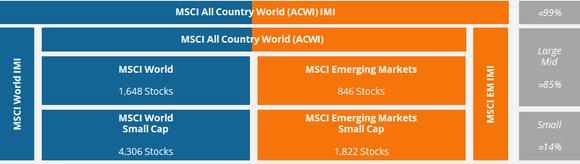

Most countries have one, and multiple organisations formulate aproaches to invest in whole continents. A popular index creating organisation is the MSCI, which created the following indeces:

The above indeces are geography based, but they exist for everything from sectors (e.g banking, technology, agriculture) to asset types (e.g. stocks, real estate).

The choice of index depends on how diversitied across the world you want to be. Personally I'm a big fan of the MSCI IMI, which is basically an index that tracks damn near the whole planet.

Morality indeces

I am still looking into these in detail, but find the concept cool. The trouble with an agnostic 'buy me everything' index like the ACWI IMI is that you will also be profiting from:

- Weapons

- Polluting companies

- 'Human phychology exploitation' (tobacco, alcohol, gambling, porn)

Now I don't mind porn and love uclear energy. Controversial weapons and oil however ring some 'maybe not so cool to profit from' bells in my mind.

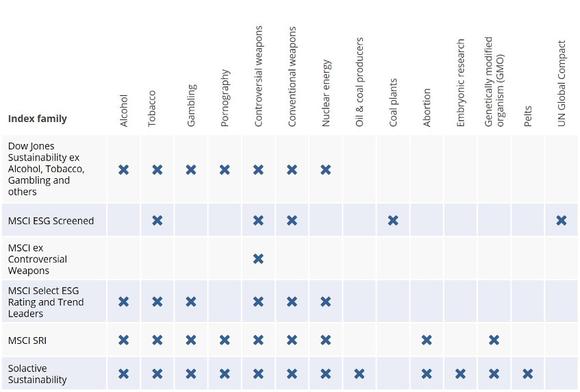

The MSCI does create indeces for those cases, though some of them are a but dumb in my personal views.

These are an overview of the exclusions of different indeces:

A cautionary note: the point of index funds is to is to invest without making human decisions, because the average human sucks at making decisions.

I have not vetted any of these indeces so can't speak to whether they are good investments from a diversification standpoint (though I plan to do a deep dive into them).

Choosing a fund that implements your strategy

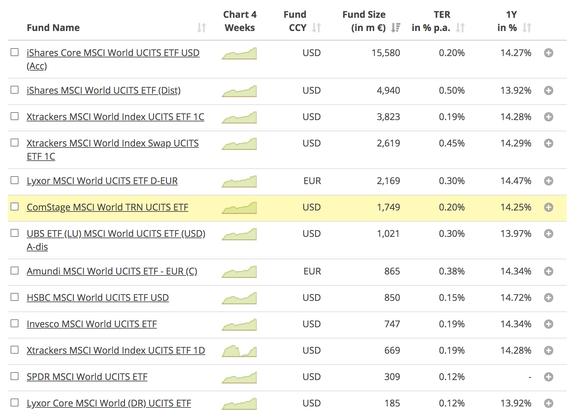

Ok, so now you have decided on your index. Let's say you chose MSCI World, which exclude the emerging markets and smaller companies.

I recommend screening ETFs using the JustETF website. If you would look up the MSCI world, you will see that there are a lot of entries:

How on earth do you decide which one you are going to look up at your broker's website?

Honestly, the default metrics on the website are not very useful on my opinion. The 4 week chart and 1Y return draw your attention away form what matters: a sound strategy and proper implementation.

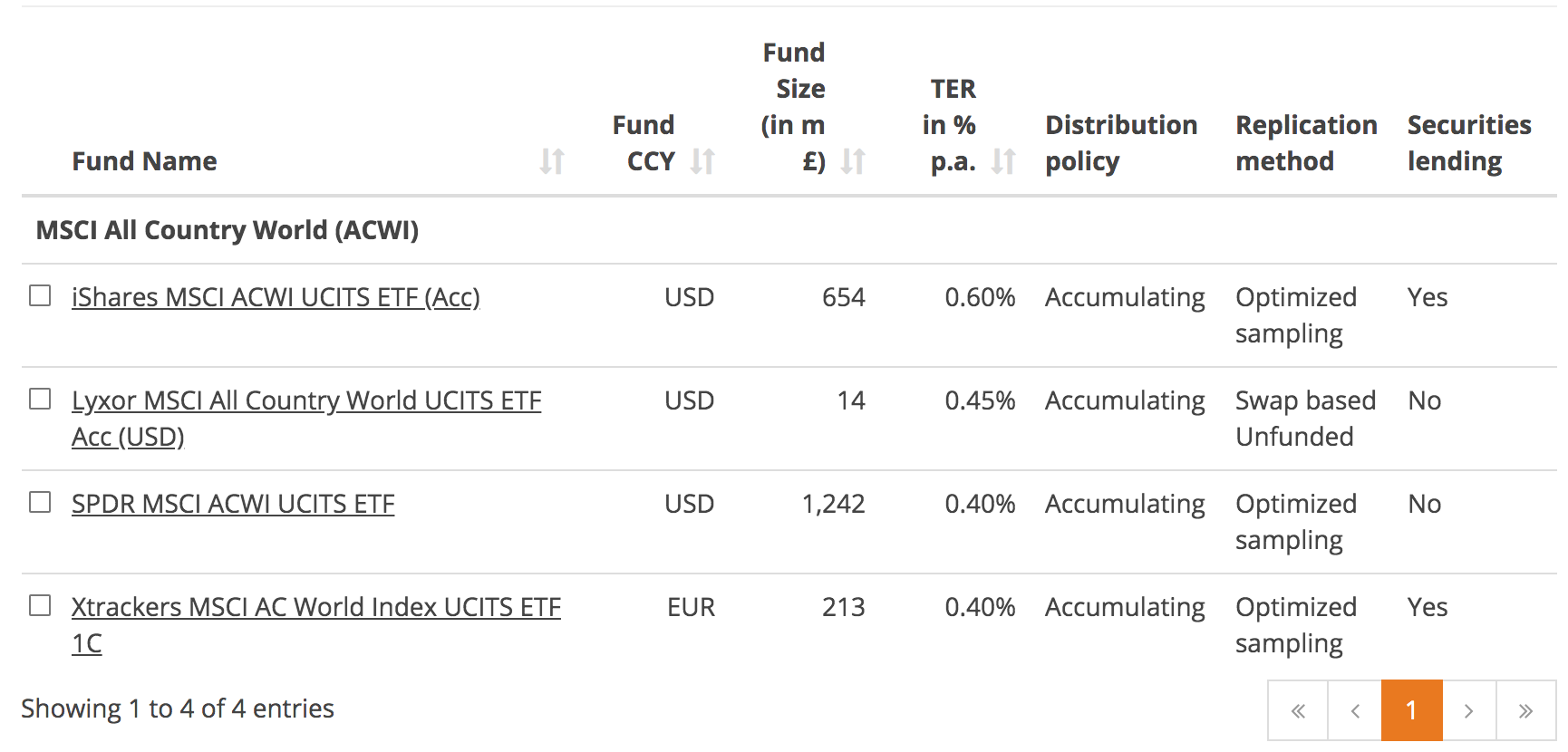

I use the 'select columns' button to select my favorites, changing the overview to the following (usign MSCI ACWI as an example):

The Total Expense Ratio (TER)

The company that implements the index strategy charges a fee. The TER describes all the costs of the underlying management. In the image above the "TER in % p.a." means the Total Expense Ration per annum (per year).

As a general rule, a lower TER is better

The caveat in that is that you want to make sure the costs aren't low because the provider is cutting corners somehow.

A 'normal' TER for a passive fund like this is between 0.1% and 0.5% depending on the specific parameters of the ETF.

Replication strategy

There are many ways to implement an index, for example's sake let's say we have a fictional index called "the idiot index" (TII). The TII index follows these stocks in the following proportions:

| Stock | Proportion |

|---|---|

| Apple | 50% |

| 50% |

Suppose I am a company called "Mentor Financial Products" (MFP) and I decide I want to create an ETF to implement TII.

I could:

- Buy 0.5 shares of Apple and Google for every share in the ETF I create

- Buy about 0.5 shares of each, depending on how easy it is to buy those shares

- Do something entirely different but pay you based on the performance of the TII index

These three are the actual ways in which funds implement indeces.

| Replication | Means |

|---|---|

| Physical | Buy exactly what the index says |

| Optimized sampling | Buy sort of what the index says |

| Synthetic | Do anything, but pay out based on the index performance |

The above is ranked from 'hard and expesive' to 'easier and cheaper'. I tend to stay away from the synthetic implementations.

All the reports I read on synthetic ETFs say "oh it's fine don't worry", but my intincs tell me to run

If you have no other options, at least go for a synthetic ETF with collateral (yes you have ones without collateral, fuck me right...).

Summary, from preferred to less preferred:

- Full physical

- Optimized sampling physical

- Synthetic (unfunded)

- Synthetic (funded)

Securities lending

It is a very common practice for a fund to lend securities to others for a small fee. This means that of the shares that belong to you and the other ETF holders, some of them are borrowed to other traders, to for example make speculative bets.

I'd like to emphasise that securities lending is a very normal practice and is not per definition problematic. But I'm of the mind that this introduces risks, which I'm not a fan of.

Normal doesn't mean safe (or unsafe)

I recommend avoiding securities lending if all else is equal.

Distribution policy

The shares inside your ETF are paying dividends, which belong to you. You can either choose an ETF that:

- Gives it to you directly (distributing ETF)

- Buys more of the index with the dividends (accumulating ETF)

For long-term wealth growing accumulating ETFs make most sense since they re-invest your profits automatically. Plus, dividend payments often incur transaction costs with your broker, and depending on your country income taxes.

Fund CCY and Hedging

The CCY is the currency of the fund, meaning the currency in which you buy it and in which it pays you (if it is a distributing fund).

Hedging is the practice of covering currency risk.

Let's say you are like me (European), that means:

- Your living costs are in Euro

- The global indeces are US stock heavy

- By extension you have high exposure to the dollar

In a situation where US stocks double in value, but the value of the dollar relative to the euro halves, you make no profit (your stocks double, but their value in your currency remains the same).

Likewise, US companies can crash by 25%. If the dollar at the same time become 3x more valuable than the euro, you actually make a profit in your local currency.

If this is something you worry about, you can choose to buy a currency hedged ETF. Personally I don't do it because I have enough faith in the US dollar (relative to the European euro).